[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”]

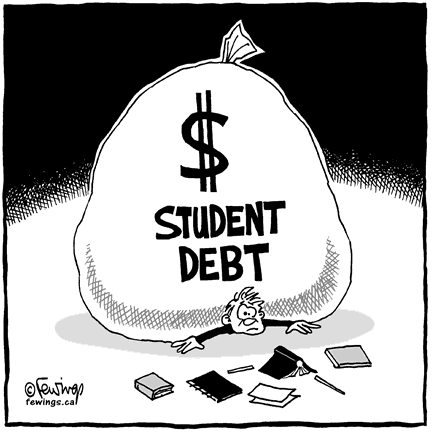

Last week, the Senate unveiled a proposed compromise on the issue of student loans. CNN Money reported the brokered deal, which is widely viewed as a short-term fix that kicks the can down the road. Rates would be lower than 5% over the next two years, but rise sharply thereafter to 7% for undergrads and 8.55% for grads in 2017.

Educational Impact: The increasing focus on the exorbitant cost of higher education is increasingly angering an already cash-strapped public. While current students are somewhat saved under the plan, students entering 9th grade this year and graduating at the end of this student loan spike may be the first generation to ask themselves, “Is college worth it?” For most teachers in many schools, our assumption has always been to ask students, “What school are you going to?” If Congress – and higher education – can’t figure out how to decrease the costs of it, we may be asking a different question of our high school seniors.[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]